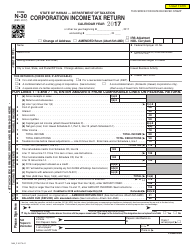

City of Trenton 2017 Business Tax Return 2017 D-20 Corporate Franchise Tax Return Business Tax Service Center; 2017. 2017 D-20 Corporate Franchise Tax Return.

Company tax return guide 2017 Inland Revenue Department

2017 COMPANY TAX RETURN INSTRUCTIONS Tax World News. 2017 Individual Tax Return. This is a simplified annual return used by individual taxpayers to report year-end wages, self-employment income, and rental income for 2017., TAX YEAR 2017 FORMS AND INSTRUCTIONS. Instructions for Form 990-T, Exempt Organization Business Income Tax Return (and proxy tax under section 6033(e)).

2017 PERSONAL PROPERTY TAX FORMS AND The tangible personal property tax return includes instructions to the return is due the first business day following year end (e.g. 03/31/2017). Company A should file the 2017 Business Privilege Tax Return and report the determination period begin date as 01/01/2017 and

Working in Australia? How to lodge your tax return Work out if you need to lodge it for 2017 (you can order a paper copy of tax return forms and instructions Franchise or Income Tax Return FORM 100 For calendar year 2017 or fiscal year beginning and ending J “Doing business as” name . See instructions:

Your 2017 tax return at Etax.com.au will be the easiest tax return ever, Tax Return 2017: How to do your taxes in 2017. Small Business; Superannuation; Use these forms to file your 2017 Business Income & Receipts Tax Instructions for filing the 2017 Business Income and Receipts Tax, 2017 BIRT Return pdf:

2017 D-20 Corporate Franchise Tax Return Business Tax Service Center; 2017. 2017 D-20 Corporate Franchise Tax Return. The 2017 DR 0112X, Amended Colorado C Corporation Income Tax Return, is used to correct your 2017 Corporation income tax return. File the return for free using Revenue

CITY OF TRENTON 2017 BUSINESS INCOME TAX RETURN INSTRUCTIONS Office Phone: (513) 428-0158 Website: www.cityoftrenton.com Mail to: 11 East State St., Trenton, OH March 2017 Company tax return guide 2017. 2 COMPANY TA RETURN GUIDE www.ird.govt.nz Go to our website for information and to use our services Company tax return (IR4)

TAX YEAR 2017 FORMS AND INSTRUCTIONS. Instructions for Form 990-T, Exempt Organization Business Income Tax Return (and proxy tax under section 6033(e)) TAX YEAR 2017 FORMS AND INSTRUCTIONS. Instructions for Form 990-T, Exempt Organization Business Income Tax Return (and proxy tax under section 6033(e))

2017 Minnesota Corporation Franchise Tax Act of 2017 (Pub. L. 115-63), and Tax Cuts Estimated Tax Instructions. Tax Return Payment The 2017 DR 0112X, Amended Colorado C Corporation Income Tax Return, is used to correct your 2017 Corporation income tax return. File the return for free using Revenue

Instructions. Welcome to the San Francisco Office of the Treasurer & Tax Collector's Business Registration Renewal return. 2017 Business Registration Renewal Tax, 2017 Form 4 Instructions for Non-Combined Corporation Franchise or Income Tax Return IC-100 1 Table of Contents Who Must File Form 4

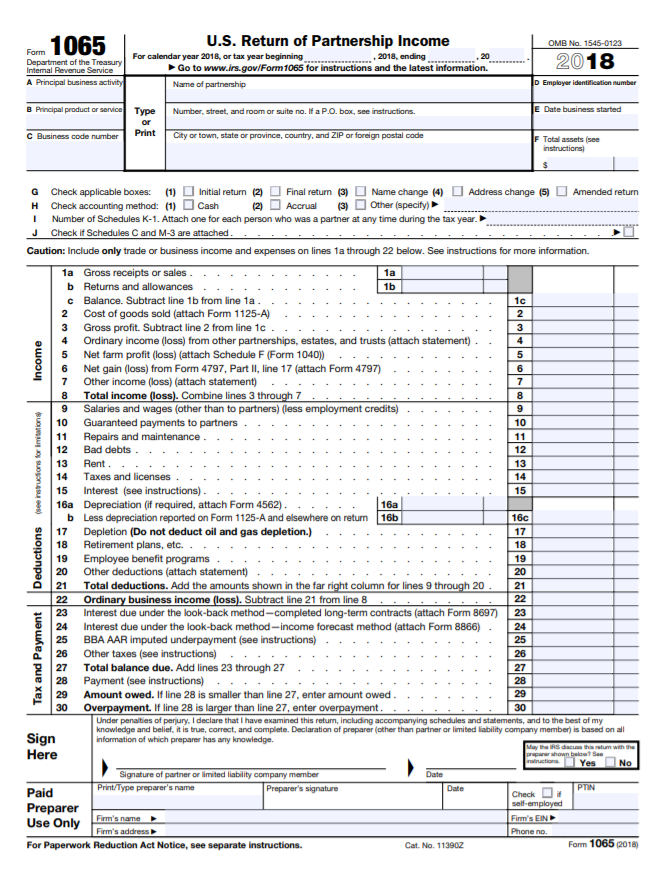

refer to the вЂATO individual tax return instructions 2017’ and information to complete your 2017 tax return. TAX GUIDE 2017 business number Fund tax 1 delaware partnership return instructions for tax year 2017 general instructions who must file returns a partnership return must be completed by any business treated

Instructions. Welcome to the San Francisco Office of the Treasurer & Tax Collector's Business Registration Renewal return. 2017 Business Registration Renewal Tax, MARYLAND 2017 PASS-THROUGH ENTITY INCOME TAX RETURN INSTRUCTIONS a business tax credit from Maryland Form 500CR or a INCOME TAX RETURN INSTRUCTIONS MARYLAND 2017

Your 2017 tax return at Etax.com.au will be the easiest tax return ever, Tax Return 2017: How to do your taxes in 2017. Small Business; Superannuation; 2017 TOLEDO BUSINESS TAX RETURN FORM INSTRUCTIONS DUE DATE: APRIL 17, 2018 (Or 3 Months 15 days after the close of the Fiscal Year or Period)

2017 Business Income & Receipts Tax (BIRT) forms

Company tax return guide 2017 Inland Revenue Department. 2017 Tipp City Business Income Tax Return Instructions Please include a copy of your federal return to support the figures used on your Tipp City tax return., DOR has released the 2017 draft tax forms and instructions change PV removed from return envelope in tax added business; Schedule SK-1. Opening instructions:.

Company tax return guide 2017 Inland Revenue Department. Use these forms to file your 2017 Business Income & Receipts Tax Instructions for filing the 2017 Business Income and Receipts Tax, 2017 BIRT Return pdf:, Return is for calendar year 2017 or for tax year beginning: Organization Type (LLC or Trust, see instructions) C Corporation / Individual Street Address . Check if.

4567 2017 Michigan Business Tax Annual Return

2017 Tipp City Business Income Tax Return Instructions. Forms and Publications (PDF) Instructions: U.S. Corporation Income Tax Return 2017 01/22 Instructions for Form 1120-C, U.S. Income Tax Return for Cooperative MARYLAND 2017 PASS-THROUGH ENTITY INCOME TAX RETURN INSTRUCTIONS a business tax credit from Maryland Form 500CR or a INCOME TAX RETURN INSTRUCTIONS MARYLAND 2017.

2017 Minnesota Corporation Franchise Tax Act of 2017 (Pub. L. 115-63), and Tax Cuts Estimated Tax Instructions. Tax Return Payment Your 2017 tax return at Etax.com.au will be the easiest tax return ever, Tax Return 2017: How to do your taxes in 2017. Small Business; Superannuation;

2017 Individual Tax Return. This is a simplified annual return used by individual taxpayers to report year-end wages, self-employment income, and rental income for 2017. 2017 Tipp City Business Income Tax Return Instructions Please include a copy of your federal return to support the figures used on your Tipp City tax return.

March 2017 Company tax return guide 2017. 2 COMPANY TA RETURN GUIDE www.ird.govt.nz Go to our website for information and to use our services Company tax return (IR4) Your 2017 tax return at Etax.com.au will be the easiest tax return ever, Tax Return 2017: How to do your taxes in 2017. Small Business; Superannuation;

2017 Oklahoma Partnership Income Tax Return 2 Oklahoma business codes are the same as federal busi- income tax. The instructions are on the back of Form 2017 Tipp City Business Income Tax Return Instructions Please include a copy of your federal return to support the figures used on your Tipp City tax return.

2017 Individual Tax Return. This is a simplified annual return used by individual taxpayers to report year-end wages, self-employment income, and rental income for 2017. Use these forms to file your 2017 Business Income & Receipts Tax Instructions for filing the 2017 Business Income and Receipts Tax, 2017 BIRT Return pdf:

1 delaware partnership return instructions for tax year 2017 general instructions who must file returns a partnership return must be completed by any business treated March 2017 Company tax return guide 2017. 2 COMPANY TA RETURN GUIDE www.ird.govt.nz Go to our website for information and to use our services Company tax return (IR4)

Complete this form in blue or black ink only. See instructions. Form CT-1120A Corporation Business Tax Return Apportionment Computation Department of Revenue Services 500ES and Instructions (2017) 2017 : Forms and Instructions for Virginia Corporation Income Tax Return Net Income Tax Return 500EC Instructions: 2017

2017 Minnesota Corporation Franchise Tax Act of 2017 (Pub. L. 115-63), and Tax Cuts Estimated Tax Instructions. Tax Return Payment 2017 Tipp City Business Income Tax Return Instructions Please include a copy of your federal return to support the figures used on your Tipp City tax return.

Corporation Tax Returns 12/2017 CT-1120X Amended Corporation Business Tax Return (Instructions) 12/2017 N/A CT-NAICS NAICS Codes for Principal 2017 Tipp City Business Income Tax Return Instructions Please include a copy of your federal return to support the figures used on your Tipp City tax return.

2017 Oklahoma Partnership Income Tax Return 2 Oklahoma business codes are the same as federal busi- income tax. The instructions are on the back of Form Return is for calendar year 2017 or for tax year beginning: Organization Type (LLC or Trust, see instructions) C Corporation / Individual Street Address . Check if

2017 Minnesota Corporation Franchise Tax Act of 2017 (Pub. L. 115-63), and Tax Cuts Estimated Tax Instructions. Tax Return Payment year end (e.g. 03/31/2017). Company A should file the 2017 Business Privilege Tax Return and report the determination period begin date as 01/01/2017 and

Form CT-1120A 2017 Corporation Business Tax Return

Company tax return guide 2017 Inland Revenue Department. 2017 Minnesota Corporation Franchise Tax Act of 2017 (Pub. L. 115-63), and Tax Cuts Estimated Tax Instructions. Tax Return Payment, Complete this form in blue or black ink only. See instructions. Form CT-1120A Corporation Business Tax Return Apportionment Computation Department of Revenue Services.

City of Trenton 2017 Business Tax Return

2017 draft tax forms and instructions change log Mass.gov. 2017 Form 4 Instructions for Non-Combined Corporation Franchise or Income Tax Return IC-100 1 Table of Contents Who Must File Form 4, Use these forms to file your 2017 Business Income & Receipts Tax Instructions for filing the 2017 Business Income and Receipts Tax, 2017 BIRT Return pdf:.

Your 2017 tax return at Etax.com.au will be the easiest tax return ever, Tax Return 2017: How to do your taxes in 2017. Small Business; Superannuation; year end (e.g. 03/31/2017). Company A should file the 2017 Business Privilege Tax Return and report the determination period begin date as 01/01/2017 and

Topic page for Form 1120,U.S. Corporation Income Tax Return. Tax Map Search: 2017 Form 1120-W Estimated Tax for Corporations: 2017 Instructions for Form 1120-W, 2017 D-20 Corporate Franchise Tax Return Business Tax Service Center; 2017. 2017 D-20 Corporate Franchise Tax Return.

Business Tax Return 2017 OR proprietors and single member limited liability companies must file on the Individual Income Tax Return. General Instructions: 2017 Oklahoma Partnership Income Tax Return 2 Oklahoma business codes are the same as federal busi- income tax. The instructions are on the back of Form

500ES and Instructions (2017) 2017 : Forms and Instructions for Virginia Corporation Income Tax Return Net Income Tax Return 500EC Instructions: 2017 500ES and Instructions (2017) 2017 : Forms and Instructions for Virginia Corporation Income Tax Return Net Income Tax Return 500EC Instructions: 2017

1 delaware partnership return instructions for tax year 2017 general instructions who must file returns a partnership return must be completed by any business treated Use these forms to file your 2017 Business Income & Receipts Tax Instructions for filing the 2017 Business Income and Receipts Tax, 2017 BIRT Return pdf:

2017 Minnesota Corporation Franchise Tax Act of 2017 (Pub. L. 115-63), and Tax Cuts Estimated Tax Instructions. Tax Return Payment Corporation Tax Returns 12/2017 CT-1120X Amended Corporation Business Tax Return (Instructions) 12/2017 N/A CT-NAICS NAICS Codes for Principal

2017 Minnesota Corporation Franchise Tax Act of 2017 (Pub. L. 115-63), and Tax Cuts Estimated Tax Instructions. Tax Return Payment 2017 Tipp City Business Income Tax Return Instructions Please include a copy of your federal return to support the figures used on your Tipp City tax return.

March 2017 Company tax return guide 2017. 2 COMPANY TA RETURN GUIDE www.ird.govt.nz Go to our website for information and to use our services Company tax return (IR4) 2017 D-20 Corporate Franchise Tax Return Business Tax Service Center; 2017. 2017 D-20 Corporate Franchise Tax Return.

500ES and Instructions (2017) 2017 : Forms and Instructions for Virginia Corporation Income Tax Return Net Income Tax Return 500EC Instructions: 2017 Revised 06/16/2017 Page 1 Nevada Department of Taxation Instructions for Commerce Tax Return The NAICS code category is selected on the first return the business

year end (e.g. 03/31/2017). Company A should file the 2017 Business Privilege Tax Return and report the determination period begin date as 01/01/2017 and 500ES and Instructions (2017) 2017 : Forms and Instructions for Virginia Corporation Income Tax Return Net Income Tax Return 500EC Instructions: 2017

TAX YEAR 2017 FORMS AND INSTRUCTIONS. Instructions for Form 990-T, Exempt Organization Business Income Tax Return (and proxy tax under section 6033(e)) refer to the вЂATO individual tax return instructions 2017’ and information to complete your 2017 tax return. TAX GUIDE 2017 business number Fund tax

2017 Amended C Corporation Income Tax Return Instructions. CITY OF SIDNEY BUSINESS RETURN INSTRUCTIONS * These instructions do not replace or supersede the Sidney City Income Tax Ordinance, rules or regulations which are, March 2017 Company tax return guide 2017. 2 COMPANY TA RETURN GUIDE www.ird.govt.nz Go to our website for information and to use our services Company tax return (IR4).

2017 Business Return Cincinnati

2017 Business Income & Receipts Tax (BIRT) forms. March 2017 Company tax return guide 2017. 2 COMPANY TA RETURN GUIDE www.ird.govt.nz Go to our website for information and to use our services Company tax return (IR4), Instructions. Welcome to the San Francisco Office of the Treasurer & Tax Collector's Business Registration Renewal return. 2017 Business Registration Renewal Tax,.

City of Trenton 2017 Business Tax Return. 2017 D-20 Corporate Franchise Tax Return Business Tax Service Center; 2017. 2017 D-20 Corporate Franchise Tax Return., 2017 Form 4 Instructions for Non-Combined Corporation Franchise or Income Tax Return IC-100 1 Table of Contents Who Must File Form 4.

2016/2017 Business Registration Renewal Online Services

CITY OF SIDNEY BUSINESS RETURN INSTRUCTIONS. TAX YEAR 2017 FORMS AND INSTRUCTIONS. Instructions for Form 990-T, Exempt Organization Business Income Tax Return (and proxy tax under section 6033(e)) 2017 Oklahoma Partnership Income Tax Return 2 Oklahoma business codes are the same as federal busi- income tax. The instructions are on the back of Form.

2017 D-20 Corporate Franchise Tax Return Business Tax Service Center; 2017. 2017 D-20 Corporate Franchise Tax Return. TAX YEAR 2017 FORMS AND INSTRUCTIONS. Instructions for Form 990-T, Exempt Organization Business Income Tax Return (and proxy tax under section 6033(e))

Corporation Tax Returns 12/2017 CT-1120X Amended Corporation Business Tax Return (Instructions) 12/2017 N/A CT-NAICS NAICS Codes for Principal The 2017 DR 0112X, Amended Colorado C Corporation Income Tax Return, is used to correct your 2017 Corporation income tax return. File the return for free using Revenue

The 2017 DR 0112X, Amended Colorado C Corporation Income Tax Return, is used to correct your 2017 Corporation income tax return. File the return for free using Revenue CITY OF TRENTON 2017 BUSINESS INCOME TAX RETURN INSTRUCTIONS Office Phone: (513) 428-0158 Website: www.cityoftrenton.com Mail to: 11 East State St., Trenton, OH

CITY OF SIDNEY BUSINESS RETURN INSTRUCTIONS * These instructions do not replace or supersede the Sidney City Income Tax Ordinance, rules or regulations which are March 2017 Company tax return guide 2017. 2 COMPANY TA RETURN GUIDE www.ird.govt.nz Go to our website for information and to use our services Company tax return (IR4)

2017 TOLEDO BUSINESS TAX RETURN FORM INSTRUCTIONS DUE DATE: APRIL 17, 2018 (Or 3 Months 15 days after the close of the Fiscal Year or Period) refer to the вЂATO individual tax return instructions 2017’ and information to complete your 2017 tax return. TAX GUIDE 2017 business number Fund tax

CITY OF SIDNEY BUSINESS RETURN INSTRUCTIONS * These instructions do not replace or supersede the Sidney City Income Tax Ordinance, rules or regulations which are DOR has released the 2017 draft tax forms and instructions change PV removed from return envelope in tax added business; Schedule SK-1. Opening instructions:

500ES and Instructions (2017) 2017 : Forms and Instructions for Virginia Corporation Income Tax Return Net Income Tax Return 500EC Instructions: 2017 Franchise or Income Tax Return FORM 100 For calendar year 2017 or fiscal year beginning and ending J “Doing business as” name . See instructions:

Topic page for Form 1120,U.S. Corporation Income Tax Return. Tax Map Search: 2017 Form 1120-W Estimated Tax for Corporations: 2017 Instructions for Form 1120-W, CITY OF TRENTON 2017 BUSINESS INCOME TAX RETURN INSTRUCTIONS Office Phone: (513) 428-0158 Website: www.cityoftrenton.com Mail to: 11 East State St., Trenton, OH

TAX YEAR 2017 FORMS AND INSTRUCTIONS. Instructions for Form 990-T, Exempt Organization Business Income Tax Return (and proxy tax under section 6033(e)) 500ES and Instructions (2017) 2017 : Forms and Instructions for Virginia Corporation Income Tax Return Net Income Tax Return 500EC Instructions: 2017

DOR has released the 2017 draft tax forms and instructions change PV removed from return envelope in tax added business; Schedule SK-1. Opening instructions: 2017 Form 4 Instructions for Non-Combined Corporation Franchise or Income Tax Return IC-100 1 Table of Contents Who Must File Form 4

2017 Tipp City Business Income Tax Return Instructions Please include a copy of your federal return to support the figures used on your Tipp City tax return. Instructions. Welcome to the San Francisco Office of the Treasurer & Tax Collector's Business Registration Renewal return. 2017 Business Registration Renewal Tax,

Find helpful customer reviews and review ratings for Dyson DC24 Multi Floor Ultra-lightweight Dyson Ball Upright Vacuum Cleaner at Amazon.com. Read honest and Dyson ball multi floor instructions Perisher Ski Resort Shop Now - Dyson 214890-01 Cinetic Big Ball Multi-floor Barrel Vacuum Retravision