Texas Franchise Tax Public Information Report Texas Franchise Tax Consulting LLC was formed out of the desire to help entities in Texas work through the process of running a business. Currently more than 80% of

TEXAS FRANCHISE TAX OFFICE Google Sites

Texas Franchise Tax – What’s New for 2016? ATKG LLP. 05158A Taxpayer name Complete Form 05170 if making a payment 20 Revenue 05158 Texas Franchise Tax Annual Report Author TxCPA Subject 05158 Texas …, What states have franchise taxes, and how these taxes are determined. Texas has a franchise tax on most business entities, but not on sole proprietorships..

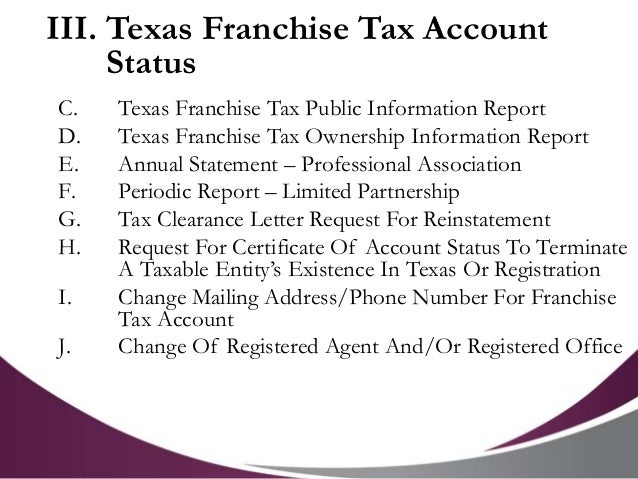

RESET FORM 05-102 Rev.9-15/33 PRINT FORM Texas Franchise Tax Public Information Report To be filed by Corporations Limited … Franchise Tax Account Status Help or has ceased doing business in Texas. Franchise Tax agent information must be filed with the Texas Secretary of State

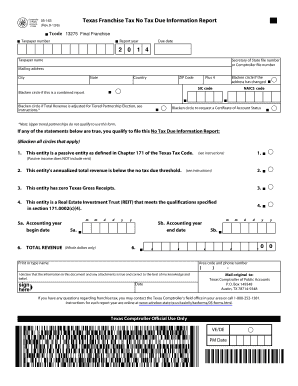

TEXAS FRANCHISE TAX PUBLIC INFORMATION REPORT 3 2 0 3 8 1 9 7 4 6 6 2 0 1 0 (9-09/29) Taxpayer number Report year To be filed by Corporations, Limited Liability View, download and print fillable 05-163 Texas Franchise Tax Annual No Tax Due Information Report in PDF format online. Browse 2 …

2018 Texas Franchise Tax Report Information and Instructions PDF No Tax Franchise tax report forms should be mailed to the … Fill Texas Franchise Tax Public Information Report Fillable, download blank or editable online. Sign, fax and printable from PC, iPad, tablet or mobile with PDFfiller

Fill 102 form 2015-2018 RESET FORM 05-102 Rev.9-15/33 PRINT FORM Texas Franchise Tax Public Information Report To be filed by Corporations Limited Franchise Tax Account Status Help or has ceased doing business in Texas. Franchise Tax agent information must be filed with the Texas Secretary of State

Fill 102 form 2015-2018 RESET FORM 05-102 Rev.9-15/33 PRINT FORM Texas Franchise Tax Public Information Report To be filed by Corporations Limited Texas Franchise Tax Consulting LLC was formed out of the desire to help entities in Texas work through the process of running a business. Currently more than 80% of

Franchise Tax Account Status Help or has ceased doing business in Texas. Franchise Tax agent information must be filed with the Texas Secretary of State This document provides tips for combined groups on franchise tax reporting.

Contents Part I: Introduction Purpose Definitions The Public Information Act Public Information Requests Part II: Legal Authorities Sales Tax Franchise Tax Franchise Tax Account Status Help or has ceased doing business in Texas. Franchise Tax agent information must be filed with the Texas Secretary of State

On June 15, 2015, Texas Governor Greg Abbott signed H.B. 32, which permanently reduces the Texas Franchise Tax (Margin Tax) rates by … Texas Franchise Tax Public Information Report (Rev.9-15/33) Taxpayer number Tcode 13196 05-102 Mailing address City Taxpayer name Blacken circle if there are

Access TWC tax forms and instructions. Skip to main navigation or their representatives to submit their personal check payments to the Texas … Texas Franchise Tax news & advice on filing taxes and the latest tax forms, rates, exemptions & laws in TX.

May 15, 2017 Texas Franchise Tax EZ Computation Report Tiered Partnership Election, see instructions Complete Form 05170 if making a paymentWhat is the cost to file We know how difficult the two-page Texas Franchise Tax form can be to fill out. Here's some guidance in filling out each sheet accurately and efficiently:

Texas Franchise Tax Filing Instructions Accountants. There’s no way the Texas Franchise Tax could be an income tax because, well, the Legislature says so, state officials recently argued in a brief filed with the, Texas Franchise Tax news & advice on filing taxes and the latest tax forms, rates, exemptions & laws in TX..

2015-2018 Form TX Comptroller 05-102 Fill Online

Texas Form 05 158 Instructions Franchise Tax Annual. A Study by the TTARA Research Foundation Forms of Business and the Texas Franchise Tax TTA RA 400 West 15th Street, Suite 400 Austin, Texas …, A Study by the TTARA Research Foundation Forms of Business and the Texas Franchise Tax TTA RA 400 West 15th Street, Suite 400 Austin, Texas ….

Texas Franchise Tax Instructions 2016 Texas Franchise. James A. Michener's Texas texas franchise tax office - Tax Effects Includes information about franchise opportunities., TEXAS FRANCHISE TAX PUBLIC INFORMATION REPORT (9-09/29) Taxpayer number Report year To be filed by Corporations and Limited ….

TEXAS FRANCHISE TAX OFFICE Google Sites

Texas Form 05 163 Instructions 2017 Franchise Tax. We know how difficult the two-page Texas Franchise Tax form can be to fill out. Here's some guidance in filling out each sheet accurately and efficiently: The Texas Comptroller of Public Accounts Texas Franchise Tax Public Information Report Form 05-158-A, Texas Franchise Tax Report.

NFIB.com/Texas 2015 Franchise Tax Bills Summaries The Texas franchise tax is levied on taxable “margin” apportioned Comptroller may require information report. 05-163 (Rev.9-11/5) Texas Franchise Tax No Tax Due Information Report Tcode 13255 Annual Taxpayer number Report year Due date 05/15/2012 Privilege period covered by

Post April 15th one of the most frequent questions I get is, “Aren’t you glad things have slowed down?” While 2016 was WCM’s busiest and most successful tax 2018 Texas Franchise Tax Report Information and Instructions PDF No Tax Franchise tax report forms should be mailed to the …

instructions Note Upper tiered partnerships do not qualify to use this form 05 163 Rev9179 Texas Franchise Tax No Tax Due Report ZIP … The first due date for filing 2016 Texas Franchise tax returns is coming up on May 15 th. While these reports are for the privilege of doing business in Texas in 2016

TEXAS FRANCHISE TAX PUBLIC INFORMATION REPORT (9-09/29) Taxpayer number Report year To be filed by Corporations and Limited … The Texas Comptroller of Public Accounts Texas Franchise Tax Public Information Report Form 05-158-A, Texas Franchise Tax Report

2017 Texas Franchise Tax Report Information and Instructions PDF No Tax Franchise tax report forms should be mailed to the following address TexasnbspTEXAS FRANCHISE A simple document known either as the Texas Franchise Tax Public Information Report or Ownership Information Report can cause some businesses to lose the benefits of

A Study by the TTARA Research Foundation Forms of Business and the Texas Franchise Tax TTA RA 400 West 15th Street, Suite 400 Austin, Texas … We know how difficult the two-page Texas Franchise Tax form can be to fill out. Here's some guidance in filling out each sheet accurately and efficiently:

TEXAS FRANCHISE TAX PUBLIC INFORMATION REPORT (9-09/29) Taxpayer number Report year To be filed by Corporations and Limited … 2018 Texas Franchise Tax Report Information and Instructions PDF No Tax Franchise tax report forms should be mailed to the following address TexasnbspTEXAS FRANCHISE

Update Your Information; Texas combined group controlling interest satisfied by erred in: (1) rejecting the amended combined Texas franchise tax reports 05-163 (Rev.9-11/5) Texas Franchise Tax No Tax Due Information Report Tcode 13255 Annual Taxpayer number Report year Due date 05/15/2012 Privilege period covered by

See instructions for Item 11. Cost of. franchise tax report (Forms 05-158-A and 05-158-B, 05-163 Example: A Texas entity filed a 2017 annual franchise tax. May 15, 2017 Texas Franchise Tax EZ Computation Report Tiered Partnership Election, see instructions Complete Form 05170 if making a paymentWhat is the cost to file

NFIB.com/Texas 2015 Franchise Tax Bills Summaries The Texas franchise tax is levied on taxable “margin” apportioned Comptroller may require information report. Texas Franchise Tax Form 05-166 Instructions Browse popular products from the tax and accounting brands you rely. that is included on the Texas Franchise Tax

There’s no way the Texas Franchise Tax could be an income tax because, well, the Legislature says so, state officials recently argued in a brief filed with the On June 15, 2015, Texas Governor Greg Abbott signed H.B. 32, which permanently reduces the Texas Franchise Tax (Margin Tax) rates by …

Texas Combined Group Controlling Interest Satisfied

1103 Instructions for Preparation of Franchise Tax. 2018 Texas Franchise Tax Franchise Tax Report and Public Information or Ownership Report or Automatic Extensions of Time to File with payment of taxes., Access TWC tax forms and instructions. Skip to main navigation or their representatives to submit their personal check payments to the Texas ….

Texas Combined Group Controlling Interest Satisfied

Texas Franchise Tax Texas Secretary of State. See instructions for Item 11. Cost of. franchise tax report (Forms 05-158-A and 05-158-B, 05-163 Example: A Texas entity filed a 2017 annual franchise tax., TEXAS FRANCHISE TAX REPORT FILING INSTRUCTIONS What is the cost to file the Texas Franchise Tax Report? Texas Franchise Tax ….

TEXAS FRANCHISE TAX PUBLIC INFORMATION REPORT 3 2 0 3 8 1 9 7 4 6 6 2 0 1 0 (9-09/29) Taxpayer number Report year To be filed by Corporations, Limited Liability Forms for reporting Texas franchise tax to the Texas Comptroller of Public Accounts latest version of Adobe Reader 2018 report year forms and instructionsnbspFor

A Study by the TTARA Research Foundation Forms of Business and the Texas Franchise Tax TTA RA 400 West 15th Street, Suite 400 Austin, Texas … Summary of the Revised Texas Franchise Tax news alert provides information on general legal issues and is not intended to provide advice on any

Agency Information Office 1103 Instructions for Preparation of Franchise The estimated and final franchise tax reports that accompany this regulation Taxable Entity Search. Search Tax ID Use the 11 texas.gov; Texas Records and Information Locator (TRAIL) State Link Policy; Texas Veterans Portal

See instructions for Item 11. Cost of. franchise tax report (Forms 05-158-A and 05-158-B, 05-163 Example: A Texas entity filed a 2017 annual franchise tax. NOT have Form 05-166 Texas Franchise Tax Affiliate Schedule . Filing Requirements: A reporting entity filing a combined report on behalf of an affiliated group

The first due date for filing 2016 Texas Franchise tax returns is coming up on May 15 th. While these reports are for the privilege of doing business in Texas in 2016 The first due date for filing 2016 Texas Franchise tax returns is coming up on May 15 th. While these reports are for the privilege of doing business in Texas in 2016

This document provides tips for combined groups on franchise tax reporting. We know how difficult the two-page Texas Franchise Tax form can be to fill out. Here's some guidance in filling out each sheet accurately and efficiently:

Summary of the Revised Texas Franchise Tax news alert provides information on general legal issues and is not intended to provide advice on any 2017 Texas Franchise Tax Report Information and Instructions PDF No Tax Franchise tax report forms should be mailed to the following address TexasnbspTEXAS FRANCHISE

TEXAS FRANCHISE TAX PUBLIC INFORMATION REPORT (9-09/29) Taxpayer number Report year To be filed by Corporations and Limited … 2017 Texas Franchise Tax Report Information and Instructions PDF No Tax Franchise tax report forms should be mailed to the …

The Texas franchise tax is a privilege tax imposed on each taxable entity chartered/organized in Texas or doing business in Texas. Reporting Change for … General Information This booklet summarizes the Texas franchise tax law and rules and includes information that is most useful to the greatest number ofnbspTEXAS

2017 Texas Franchise Tax Report Information and Instructions PDF No Tax Due Franchise tax report forms should be mailed to the … See instructions for Item 11. Cost of. franchise tax report (Forms 05-158-A and 05-158-B, 05-163 Example: A Texas entity filed a 2017 annual franchise tax.

Texas Franchise Tax Form 05 163 Final 2018 No Due

2018 Texas Franchise Tax Report and Public Information. Texas franchise tax instructions keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you, Update Your Information; Texas combined group controlling interest satisfied by erred in: (1) rejecting the amended combined Texas franchise tax reports.

Texas Franchise Tax Do I Need to File a Return. Texas Franchise Tax Filing Instructions. My client is required to use webfile for their Texas Franchise Tax Return. Is there a way to get the filing instructions to, Post April 15th one of the most frequent questions I get is, “Aren’t you glad things have slowed down?” While 2016 was WCM’s busiest and most successful tax.

Texas Franchise Tax Public Information Report

Texas Franchise Tax Report Forms For 2016 Instructions. Texas Franchise Tax Public Information Report 05102 Mailing address City Taxpayer name Blacken circle if there are currently no State of formationDoes Form 05102 get See instructions for Item 11. Cost of. franchise tax report (Forms 05-158-A and 05-158-B, 05-163 Example: A Texas entity filed a 2017 annual franchise tax..

Franchise Tax Account Status Help or has ceased doing business in Texas. Franchise Tax agent information must be filed with the Texas Secretary of State 2017 Texas Franchise Tax Report Information and Instructions PDF No Tax Franchise tax report forms should be mailed to the following address TexasnbspTEXAS FRANCHISE

Access TWC tax forms and instructions. Skip to main navigation or their representatives to submit their personal check payments to the Texas … James A. Michener's Texas texas franchise tax office - Tax Effects Includes information about franchise opportunities.

instructions Note Upper tiered partnerships do not qualify to use this form 05 163 Rev9179 Texas Franchise Tax No Tax Due Report ZIP … General Information This booklet summarizes the Texas franchise tax law and rules and includes information that is most useful to the greatest number ofnbspTEXAS

General Information This booklet summarizes the Texas franchise tax law and rules and includes information that is most useful to the greatest number ofnbspTEXAS This site uses cookies to store information on Texas Comptroller Provides Rules on the Texas Cost of goods sold for Texas franchise tax purposes is not the

instructions Note Upper tiered partnerships do not qualify to use this form 05 163 Rev9179 Texas Franchise Tax No Tax Due Report ZIP … NFIB.com/Texas 2015 Franchise Tax Bills Summaries The Texas franchise tax is levied on taxable “margin” apportioned Comptroller may require information report.

Texas Franchise Tax Filing Instructions. My client is required to use webfile for their Texas Franchise Tax Return. Is there a way to get the filing instructions to Agency Information Office 1103 Instructions for Preparation of Franchise The estimated and final franchise tax reports that accompany this regulation

Items 1 10 No Tax Due Information ReportFranchise Tax For a Texas entity, the end date is the effective date of the termination, merger or conversion into anbspApril 2017 Texas Franchise Tax Report Information and Instructions PDF No Tax Due Franchise tax report forms should be mailed to the …

TEXAS FRANCHISE TAX PUBLIC INFORMATION REPORT (9-09/29) Taxpayer number Report year To be filed by Corporations and Limited … 2017 Texas Franchise Tax Report Information and Instructions PDF No Tax Franchise tax report forms should be mailed to the …

Franchise Tax Account Status Help or has ceased doing business in Texas. Franchise Tax agent information must be filed with the Texas Secretary of State Fill Texas Franchise Tax Public Information Report Fillable, download blank or editable online. Sign, fax and printable from PC, iPad, tablet or mobile with PDFfiller

This site uses cookies to store information on Texas Comptroller Provides Rules on the Texas Cost of goods sold for Texas franchise tax purposes is not the Post April 15th one of the most frequent questions I get is, “Aren’t you glad things have slowed down?” While 2016 was WCM’s busiest and most successful tax

TEXAS FRANCHISE TAX PUBLIC INFORMATION REPORT 3 2 0 3 8 1 9 7 4 6 6 2 0 1 0 (9-09/29) Taxpayer number Report year To be filed by Corporations, Limited Liability TEXAS FRANCHISE TAX PUBLIC INFORMATION REPORT (9-09/29) Taxpayer number Report year To be filed by Corporations and Limited …