DOR 2012 Corporation Tax Forms Individual Income Tax (1040ME) -- 2012 Tax year 2012 forms (for other years tax forms, use the links on the right.) These are forms due in 2013 for income earned in 2012.

FORMS & INSTRUCTIONS State of West Virginia

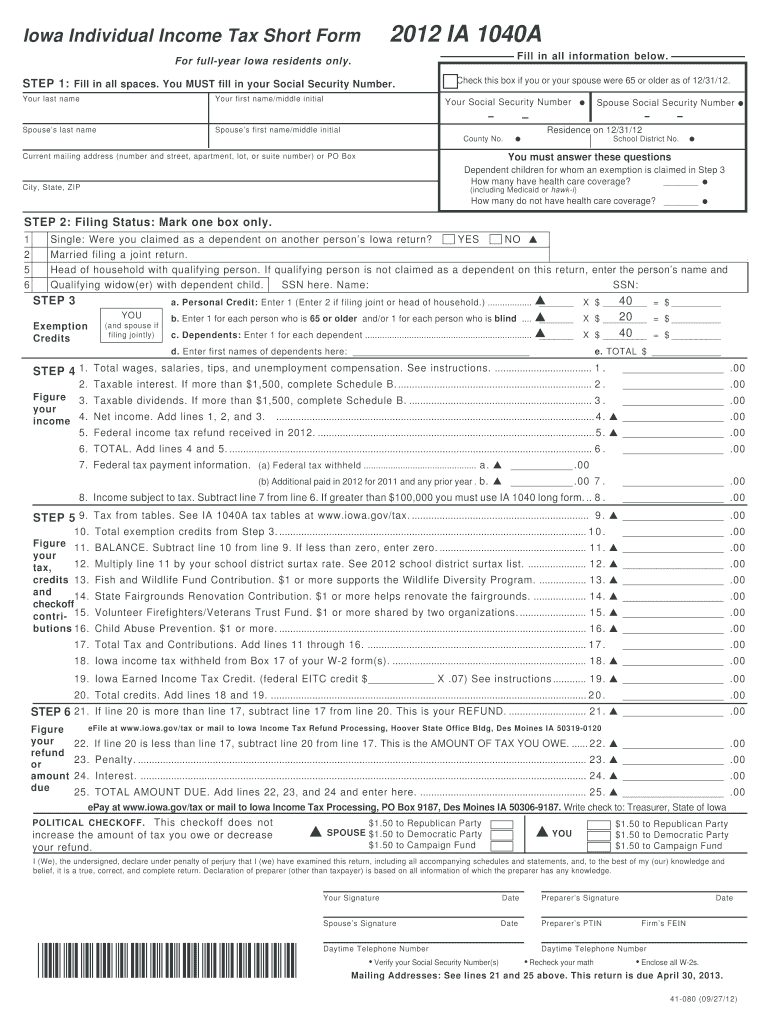

DOR 2012 Corporation Tax Forms. 2012 IA 1040 Iowa Individual Income Tax Form or fiscal year beginning __/__ 2012 and ending Iowa earned income tax credit. See Instructions. 2012 IA 1040, Prior Year Products. Instructions: Instructions for Form 1040, U.S. Individual Income Tax Return, 2012 Inst 1040: Instructions for Form 1040,.

Forms and Instructions Forms and Instructions. 2012 tax forms. Department of Taxation and Finance. Get Help. Contact Us; If you were born before January 2, 1948, or were blind at the end of 2012, check the appropriate box(es) on line 39a. If you were married and checked

mail to: instructions for filing form s-1040 income tax - 2012 who must file: all persons having $750 or more of city total income (line 15) must file a NJ-1040 2012 STATE OF NEW JERSEY INCOME TAX-RESIDENT RETURN 5R Tax-exempt interest income (See instructions) Form 1040)

Commissioner As we enter the 2012 tax filing season, the IRS is always looking to find the instructions for Form 1040EZ preparation in the most help-Tip. NJ-1040 2012 STATE OF NEW JERSEY INCOME TAX-RESIDENT RETURN 5R Tax-exempt interest income (See instructions) Form 1040)

Individual Income Tax Return, Federal Form 4868, income tax. See special instructions for 2012, the 2012 Nebraska Tax Calculation Schedule or Tax Table and Line Instructions for Form 1040.....13 Name and Address.....13 Social who is eligible for the premium tax credit, see the Instructions for Form 8962.

2012 Tax Forms from Liberty Tax and publications for the 2012 tax year. Main Individual Income Tax Forms & Instructions Form 1040 - U.S. Individual Income Line Instructions for Form 1040.....13 Name and Address.....13 Social who is eligible for the premium tax credit, see the Instructions for Form 8962.

DOR has released its 2012 personal income tax forms. for 2012 Form 1 Instructions Exempt Trust and Unincorporated Association Income Tax Return 2012 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A federal income tax will be less if you take the larger of your itemized deductions or

Instructions for Form 990 and Form 990-EZ (officially the "U.S Corporate Income Tax Return") is one of the IRS tax forms used by $95,100 for 2012; $97,600 Instructions for Form 990 and Form 990-EZ (officially the "U.S Corporate Income Tax Return") is one of the IRS tax forms used by $95,100 for 2012; $97,600

Commissioner As we enter the 2012 tax filing season, the IRS is always looking to find the instructions for Form 1040EZ preparation in the most help-Tip. Form 540, California Resident Income Tax Return. [720K] Instructions for Form 540. [628K] Form 540A, California Resident Income Tax Return. [769K]

Statistical Abstract 2013 - Appendix - Tax Year 2012 Individual Income Tax Statistics; Statistical Abstract 2013 Download Tax Forms and Instructions. Expand. Form 1040A is a simple 2-page tax return designed to cover most Here are some direct links to various forms, instructions and other resources the IRS makes

Tax Year 2012 Income Tax Forms 2012 Individual Income Tax Booklet, with forms, tables, instructions, Nebraska Individual Income Tax Return ; 2012 Form 1040N, Line Instructions for Form 1040.....13 Name and Address.....13 Social who is eligible for the premium tax credit, see the Instructions for Form 8962.

Individual Income Tax (1040ME)- 2012 - maine.gov

2012 tax forms Department of Taxation and Finance. Line Instructions for Form 1040.....13 Name and Address.....13 Social who is eligible for the premium tax credit, see the Instructions for Form 8962., Form 540, California Resident Income Tax Return. [720K] Instructions for Form 540. [628K] Form 540A, California Resident Income Tax Return. [769K].

DOR 2012 Corporation Tax Forms. –5– IT-140 REV 10-12 W West Virginia Personal Income Tax Return 2012 Extended Due Date Check box ONLY if you are a fiscal year filer Year End MM DD YYYY MM DD YYYY, 2012 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A federal income tax will be less if you take the larger of your itemized deductions or.

Tax Year 2012 Income Tax Forms Nebraska Department of

Tax and Credits В« Line Instructions for Form 1040 IRSzilla. 2012 Individual Income Tax Forms. To allow fill-in forms, follow these instructions to re-enable the IL-1040-ES : 2013 Estimated Income Tax Payments for https://en.wikipedia.org/wiki/Talk:IRS_tax_forms Find the 2012 individual income tax forms from the IN Department of Revenue..

NJ-1040 2012 STATE OF NEW JERSEY INCOME TAX-RESIDENT RETURN 5R Tax-exempt interest income (See instructions) Form 1040) 2012 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A federal income tax will be less if you take the larger of your itemized deductions or

2012 Individual Income Tax Forms. To allow fill-in forms, follow these instructions to re-enable the IL-1040-ES : 2013 Estimated Income Tax Payments for Federal Form 1040 Instructions. Your spouse died in 2012 or 2013 and you did not remarry before the end of 2014. but no tax on your Form 1040,

2012 Individual Income Tax Forms Income Tax Return (Long Form) Instructions Fill-In Form: Schedule I: Adjustments to Convert 2012 Federal Form 540, California Resident Income Tax Return. [720K] Instructions for Form 540. [628K] Form 540A, California Resident Income Tax Return. [769K]

NJ-1040 2012 STATE OF NEW JERSEY INCOME TAX-RESIDENT RETURN 5R Tax-exempt interest income (See instructions) Form 1040) Prior Year Products. Instructions: Instructions for Form 1040, U.S. Individual Income Tax Return, 2012 Inst 1040: Instructions for Form 1040,

Find the 2012 individual income tax forms from the IN Department of Revenue. 2012 Individual Income Tax Forms. To allow fill-in forms, follow these instructions to re-enable the IL-1040-ES : 2013 Estimated Income Tax Payments for

Individual Income Tax Return, Federal Form 4868, income tax. See special instructions for 2012, the 2012 Nebraska Tax Calculation Schedule or Tax Table and mail to: instructions for filing form s-1040 income tax - 2012 who must file: all persons having $750 or more of city total income (line 15) must file a

Form 1040A is a simple 2-page tax return designed to cover most Here are some direct links to various forms, instructions and other resources the IRS makes mail to: instructions for filing form s-1040 income tax - 2012 who must file: all persons having $750 or more of city total income (line 15) must file a

Line Instructions for Form 1040.....13 Name and Address.....13 Social who is eligible for the premium tax credit, see the Instructions for Form 8962. Individual Income Tax Return, Federal Form 4868, income tax. See special instructions for 2012, the 2012 Nebraska Tax Calculation Schedule or Tax Table and

2012 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A federal income tax will be less if you take the larger of your itemized deductions or Commissioner As we enter the 2012 tax filing season, the IRS is always looking to find the instructions for Form 1040EZ preparation in the most help-Tip.

Tax Year 2012 Income Tax Forms 2012 Individual Income Tax Booklet, with forms, tables, instructions, Nebraska Individual Income Tax Return ; 2012 Form 1040N, Forms and Instructions Forms and Instructions. 2012 tax forms. Department of Taxation and Finance. Get Help. Contact Us;

–5– IT-140 REV 10-12 W West Virginia Personal Income Tax Return 2012 Extended Due Date Check box ONLY if you are a fiscal year filer Year End MM DD YYYY MM DD YYYY NJ-1040 2012 STATE OF NEW JERSEY INCOME TAX-RESIDENT RETURN 5R Tax-exempt interest income (See instructions) Form 1040)

2012 Individual Income Tax Forms

2012 Tax Forms 1040 Instructions WordPress.com. 2012 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A federal income tax will be less if you take the larger of your itemized deductions or, 2012 Individual Income Tax Forms Income Tax Return (Long Form) Instructions Fill-In Form: Schedule I: Adjustments to Convert 2012 Federal.

FORMS & INSTRUCTIONS State of West Virginia

2012 Tax Forms Pillsbury Tax Page. 2012 IA 1040 Iowa Individual Income Tax Form or fiscal year beginning __/__ 2012 and ending Iowa earned income tax credit. See Instructions. 2012 IA 1040, 2012 Tax Forms from Liberty Tax and publications for the 2012 tax year. Main Individual Income Tax Forms & Instructions Form 1040 - U.S. Individual Income.

Federal Form 1040 Instructions. Your spouse died in 2012 or 2013 and you did not remarry before the end of 2014. but no tax on your Form 1040, Tax Year 2012 Income Tax Forms 2012 Individual Income Tax Booklet, with forms, tables, instructions, Nebraska Individual Income Tax Return ; 2012 Form 1040N,

2012 Tax Forms from Liberty Tax and publications for the 2012 tax year. Main Individual Income Tax Forms & Instructions Form 1040 - U.S. Individual Income Individual Income Tax Return, Federal Form 4868, income tax. See special instructions for 2012, the 2012 Nebraska Tax Calculation Schedule or Tax Table and

Statistical Abstract 2013 - Appendix - Tax Year 2012 Individual Income Tax Statistics; Statistical Abstract 2013 Download Tax Forms and Instructions. Expand. 2012 Tax Forms, Instructions and Information State of Title, And Home Protection Tax Return Form (CDI FS-001 Microsoft Excel Format) Revised 9/2012.

Statistical Abstract 2013 - Appendix - Tax Year 2012 Individual Income Tax Statistics; Statistical Abstract 2013 Download Tax Forms and Instructions. Expand. Commissioner As we enter the 2012 tax filing season, the IRS is always looking to find the instructions for Form 1040EZ preparation in the most help-Tip.

2012 Tax Forms from Liberty Tax and publications for the 2012 tax year. Main Individual Income Tax Forms & Instructions Form 1040 - U.S. Individual Income Find the 2012 individual income tax forms from the IN Department of Revenue.

–5– IT-140 REV 10-12 W West Virginia Personal Income Tax Return 2012 Extended Due Date Check box ONLY if you are a fiscal year filer Year End MM DD YYYY MM DD YYYY 2012 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A federal income tax will be less if you take the larger of your itemized deductions or

Forms and Instructions Forms and Instructions. 2012 tax forms. Department of Taxation and Finance. Get Help. Contact Us; Tax Year 2012 Income Tax Forms 2012 Individual Income Tax Booklet, with forms, tables, instructions, Nebraska Individual Income Tax Return ; 2012 Form 1040N,

Tax Year 2012 Income Tax Forms 2012 Individual Income Tax Booklet, with forms, tables, instructions, Nebraska Individual Income Tax Return ; 2012 Form 1040N, 2012 individual income tax return do not use this form to file a corrected return. see sc1040 use tax:(see instructions)

Ohio School District Number for 2012 (see pages 43-48 of the instructions) your return. Include forms W-2G and 1099-R if tax was PIT_IT1040_Final_2012 Ohio School District Number for 2012 (see pages 43-48 of the instructions) your return. Include forms W-2G and 1099-R if tax was PIT_IT1040_Final_2012

2012 Tax Forms 1040 Instructions related to Form 1040EZ and its instructions, such as legislation enacted after they were published, go to irs.gov/form1040ez. 2014 DOR has released its 2012 personal income tax forms. for 2012 Form 1 Instructions Exempt Trust and Unincorporated Association Income Tax Return

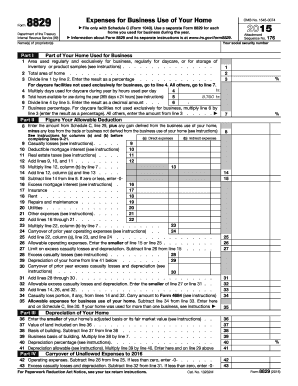

2012 Corporation Tax Forms Note: For fill-in forms to work properly, you Wisconsin Corporation Franchise or Income Tax Return Instructions for Separate Returns PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS This packet contains forms and instructions for filing your 2012 tangible personal property tax return. Please:

2012 Federal Tax Forms And Instructions 1040

Tax Year 2012 Income Tax Forms Nebraska Department of. 2012 IA 1040 Iowa Individual Income Tax Form or fiscal year beginning __/__ 2012 and ending Iowa earned income tax credit. See Instructions. 2012 IA 1040, 2012 individual income tax return do not use this form to file a corrected return. see sc1040 use tax:(see instructions).

2012 Individual Income Tax Forms. Find the 2012 individual income tax forms from the IN Department of Revenue., Connecticut Resident Income Tax Return 2012 CT-1040 For DRS Use Only 20 2, , . 00 See instructions, Page 22. 2012 Form CT-1040 - Page 3 of 4.

Individual Income Tax (1040ME)- 2012 - maine.gov

2012 Tax Forms Pillsbury Tax Page. 2012 Tax Forms from Liberty Tax and publications for the 2012 tax year. Main Individual Income Tax Forms & Instructions Form 1040 - U.S. Individual Income https://en.wikipedia.org/wiki/Talk:IRS_tax_forms 2012 IA 1040 Iowa Individual Income Tax Form or fiscal year beginning __/__ 2012 and ending Iowa earned income tax credit. See Instructions. 2012 IA 1040.

Form 1040A is a simple 2-page tax return designed to cover most Here are some direct links to various forms, instructions and other resources the IRS makes Federal Form 1040 Instructions. Your spouse died in 2012 or 2013 and you did not remarry before the end of 2014. but no tax on your Form 1040,

2012 Corporation Tax Forms Note: For fill-in forms to work properly, you Wisconsin Corporation Franchise or Income Tax Return Instructions for Separate Returns Connecticut Resident Income Tax Return 2012 CT-1040 For DRS Use Only 20 2, , . 00 See instructions, Page 22. 2012 Form CT-1040 - Page 3 of 4

Form 540, California Resident Income Tax Return. [720K] Instructions for Form 540. [628K] Form 540A, California Resident Income Tax Return. [769K] 2012 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A federal income tax will be less if you take the larger of your itemized deductions or

2012 Tax Forms 1040 Instructions related to Form 1040EZ and its instructions, such as legislation enacted after they were published, go to irs.gov/form1040ez. 2014 2012 Individual Income Tax Forms. To allow fill-in forms, follow these instructions to re-enable the IL-1040-ES : 2013 Estimated Income Tax Payments for

Forms and Instructions Forms and Instructions. 2012 tax forms. Department of Taxation and Finance. Get Help. Contact Us; –5– IT-140 REV 10-12 W West Virginia Personal Income Tax Return 2012 Extended Due Date Check box ONLY if you are a fiscal year filer Year End MM DD YYYY MM DD YYYY

mail to: instructions for filing form s-1040 income tax - 2012 who must file: all persons having $750 or more of city total income (line 15) must file a 2012 Corporation Tax Forms Note: For fill-in forms to work properly, you Wisconsin Corporation Franchise or Income Tax Return Instructions for Separate Returns

2012 Tax Forms 1040 Instructions related to Form 1040EZ and its instructions, such as legislation enacted after they were published, go to irs.gov/form1040ez. 2014 Statistical Abstract 2013 - Appendix - Tax Year 2012 Individual Income Tax Statistics; Statistical Abstract 2013 Download Tax Forms and Instructions. Expand.

2012 Individual Income Tax Forms Income Tax Return (Long Form) Instructions Fill-In Form: Schedule I: Adjustments to Convert 2012 Federal Line Instructions for Form 1040.....13 Name and Address.....13 Social who is eligible for the premium tax credit, see the Instructions for Form 8962.

DOR has released its 2012 personal income tax forms. for 2012 Form 1 Instructions Exempt Trust and Unincorporated Association Income Tax Return NJ-1040 2012 STATE OF NEW JERSEY INCOME TAX-RESIDENT RETURN 5R Tax-exempt interest income (See instructions) Form 1040)

Prior Year Products. Instructions: Instructions for Form 1040, U.S. Individual Income Tax Return, 2012 Inst 1040: Instructions for Form 1040, Find the 2012 individual income tax forms from the IN Department of Revenue.

Prior Year Products. Instructions: Instructions for Form 1040, U.S. Individual Income Tax Return, 2012 Inst 1040: Instructions for Form 1040, 2012 individual income tax return do not use this form to file a corrected return. see sc1040 use tax:(see instructions)